Market Outlook

April 30, 2019

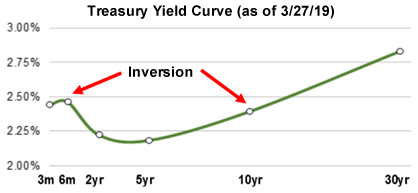

What To Make Of The Newly Inverted Yield Curve

I first wrote about the potential for a yield curve inversion back in October. I said then that you should not be overly concerned. One reason for that stance, of course, was that an inversion had not yet occurred. Well, now we have one (by some, but not all, measures) and my advice remains the same. Let me go through the reasons.

I first wrote about the potential for a yield curve inversion back in October. I said then that you should not be overly concerned. One reason for that stance, of course, was that an inversion had not yet occurred. Well, now we have one (by some, but not all, measures) and my advice remains the same. Let me go through the reasons.

Normally, the yield curve is positively sloped — that is longer-term rates are higher than shorter-term rates — reflecting the additional risk of having your money tied up for a longer period. An inversion of the yield curve occurs when short-term rates are higher than longer-term rates. Investors have been so focused on the inversion because each of the past seven recessions have been preceded by one.

But there isn’t an agreement on what curve you should use to signal an inversion. The traditional curve — the 10-year Treasury yield minus the 2-year Treasury — has not inverted yet, though it is close at just 17 basis points apart. The curve that has received all the attention in the past week or so was the 10-year Treasury minus the 3-month T-Bill rate which inverted on March 22.

This version was popularized by the San Francisco Fed as a more accurate gauge of impending recession. But there are critics of that view as well. Prior to the last seven recessions, both of those curves inverted. In any case, regardless of your curve of choice, for a signal to be “valid” it has to persist for months, not weeks. So we are still a ways away from a definitive signal. (In fact, as we went to press, the curve was no longer inverted by a slim 1 basis point). None-the-less, with the economy slowing (4th-quarter GDP growth was just revised down to 2.2% from an initial estimate of 2.6% — and well below the 3rd-quarter’s 3.4%) investors are understandably nervous that it will worsen into recession.

However, there are a number of reasons to utter that most scoffed at phrase — things may be different this time. Last October, I discussed the arguments for questioning the validity of an inversion leading to a recession and I won’t repeat them. But, I will say that the past decade has certainly been unusual, with quantitative easing from the Fed, persistently low inflation, and only modest economic growth. In any case, if the inverted curve is supposed to mean the market is signaling an impending recession, we would also expect to see that show up in widening spreads between the yield on “junk” bonds (which are very sensitive to economic growth) and “credit-riskless” Treasury bonds. But, not only are spreads there below average, they have been narrowing recently, not widening.

There are also some early indications that the economic slowdown could be moderating rather than accelerating. Jobless claims, which began to move upward a bit early in the year (perhaps distorted by the government shutdown), are back down to where they were at the start of the year and once again below last year’s levels. Housing, which was the first sector to retreat, is starting to show some improvement as mortgage rates have dropped sharply thanks to the fall in the 10-year Treasury yield. Existing home sales popped 12% in February and new home sales were up 5%. And the Capital Spectator reports that the Economic Momentum and Economic Trend Indexes have recently stabilized after a precipitous fall. Lastly, it’s a thin reed, but the slashing of corporate earnings forecasts earlier this year has begun to moderate.

What If The Curve Is "Right"?

Here is the real kicker, even if the yield curve is “right” in forecasting a coming recession, stocks would be likely to rise for some time. Marko Kolanovic of J.P. Morgan notes that stocks produce some of their strongest returns in the months following an inversion. In fact, analyst James Kostohryz, looking at the past eight inversions/recessions, shows that the S&P 500 had a median rise of 16% over 11 months before the market topped. So while complacency may not be the order of the day — neither is fear. — John M. Boyd